If you are building a break even analysis for your entire company and you sell multiple products or services you will need to figure out the average selling price for all of your products or services combined. We get Break-Even Sales at 5000 units x Rs.

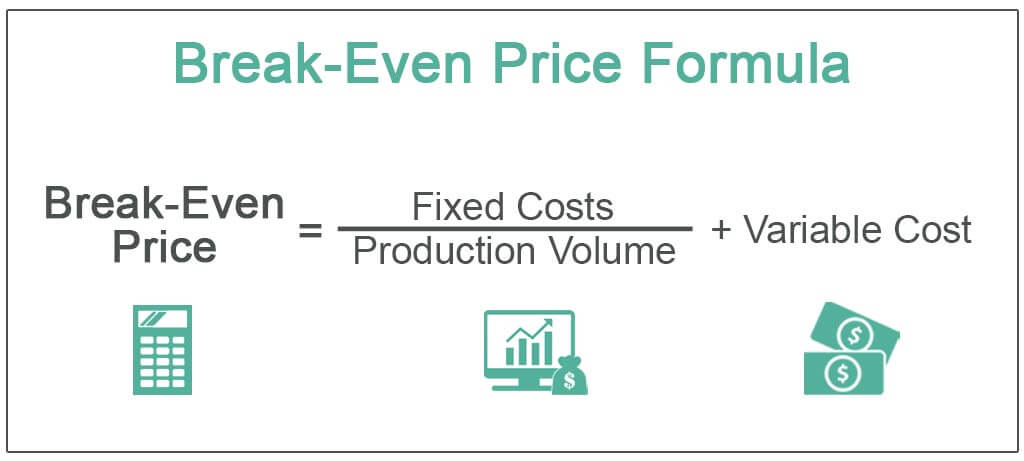

Break Even Price Formula How To Calculate Break Even Price

Break Even Analysis Learn How To Calculate The Break Even Point

What Is The Break Even Price Break Even Price Formula

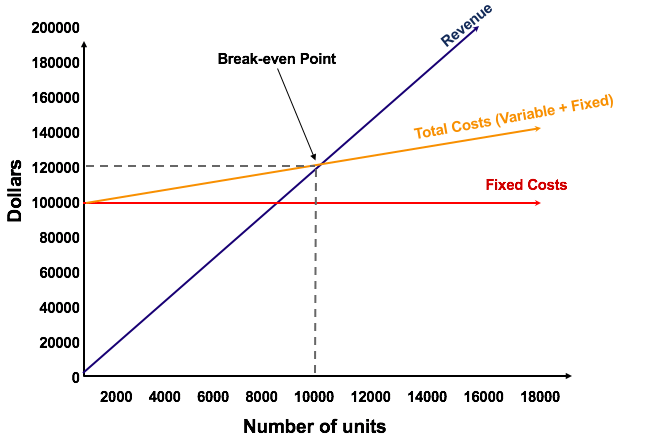

Break-even point in units is the number of goods you need to sell to reach your break-even point.

Break even price. Break-Even Point Rs. There are two formulas to calculate the break-even point. Calculate your total fixed costs.

This analysis is a common tool used in a solid business planThe formulas for the break even point are relatively simple but it can be difficult coming up with the projected sales selecting the right sale price and. He is considering introducing a new soft drink called Sams Silly Soda. For an options contract the break-even price is that level in an underlying.

Break-even point sales dollars fixed costs contribution margin. Creating your own break-even analysis template in Microsoft Excel. Fixed Costs Price - Variable Costs Break-Even Point in Units.

The break-even point calculation is a useful tool to analyse critical profit drivers of your business including sales volume average production costs and average sales price. This break-even analysis is based on the foundation of a single product or service. The Payback Period is the time it will take to break even on your investment.

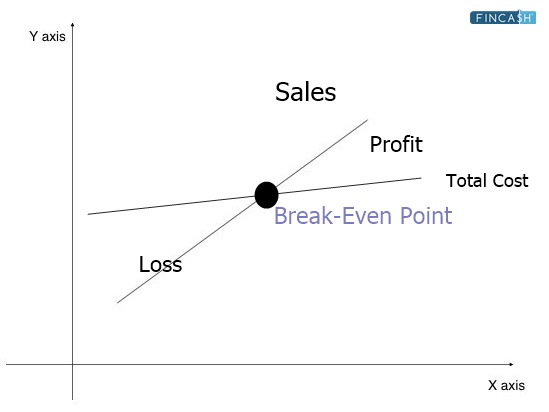

Knowing the break-even point is helpful in deciding prices setting sales budgets and preparing a business plan. The formula looks like this. In this article we look at 1 break-even analysis and how it works 2 application and benefits and 3 calculations.

Break-even point price Total Variable cost Fixed cost Number of units Break-even analysis is the process of determining an organizations break-even point. Break Even Point Formula and Example. How to use a break-even analysis.

To calculate the break-even point in units we use the formula. Break-even analysis is a way to find out the minimum sales volume so that a business does not suffer losses. Fixed Costs Sales Price Per Unit Variable Costs Per Unit.

It requires considering fixed cost variable cost price per unit and number of units. A break-even analysis allows you to determine your break-even point. The Break Even Calculator uses the following formulas.

Its important for businesses to perform a break-even analysis. You need to enter the projected or current price of the unit on which it is sold. It gives the total amount of sales in order to achieve zero loss or zero profit.

Q F P V or Break Even Point Q Fixed Cost Unit Price Variable Unit Cost Where. Break-even point is considered a measurement tool that is used in cost accounting business and economics to determine the point when both the total cost and revenues are even. Once your sales equal your fixed and variable costs you have reached the break-even point and the company will report a net profit or loss of 0.

It helps to calculate the number of units sold in order to achieve profitability which one gets after Break Even point. 200 5000 units Next this number of units can be shown in rupees by multiplying the 5000 units with the selling price of Rs. Therefore PQR Ltd has to sell 1000 pizzas in a month in order to break even.

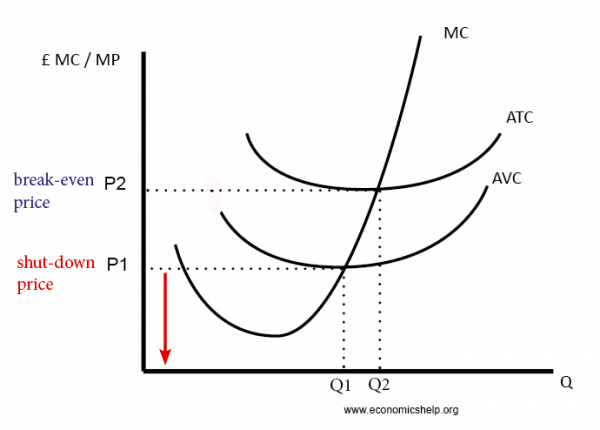

Break-even point in units fixed costs price -. Break-even analysis calculates a margin of safety where an asset price or a firms revenues can fall and still stay above the break-even point. It is a comprehensive guide to help set targets in terms of units or revenue.

Profit earned following your break even. A break-even price describes a change of value that corresponds to just covering ones initial investment or cost. Lets show a couple of examples of how to calculate the break-even point.

Any sales beyond that point contribute to your net profit. The variable cost per unit is 080 cents and each unit is sold at 2. A break-even point analysis is a powerful tool for planning and decision making and for highlighting critical information like costs quantities sold prices and so much more.

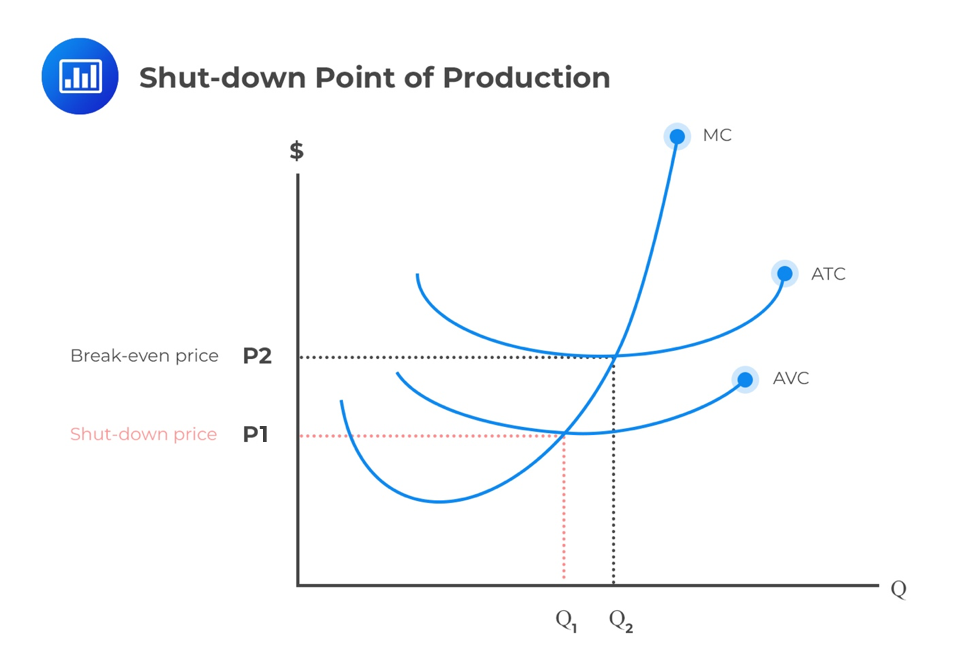

The break-even points ABC are the points of intersection between the total cost curve TC and a total revenue curve R1 R2 or R3. The break-even quantity at each selling price can be read off the horizontal axis and the break-even price at each selling price can be read off the vertical axis. Mostly the Sales Price per unit P remains constant.

Break-even point in rupees Contribution Margin. This information can make or break your business. So the total revenue equals the price P.

Break even point Fixed costs Revenue per unit Variable cost per unit In this example suppose Company As product has a fixed cost of 60000. You need to know the appropriate price you should charge for your goods or services. Fixed costs are costs that do not change with sales or volume because they are based on time.

Indicates required field. Part of making the decision would depend on the analysis process. It provides companies with targets to cover costs and make a profit.

For this calculator the time period is calculated monthly. Lis Sintha Importance of Break-Even. The break-even point in units can then be multiplied by the sales price per unit to calculate the break-even point in dollars.

However PQR is selling 1500 pizzas monthly which is higher than the break-even quantity which indicates that the company is making a profit at the. Break-even analysis one of the most popular business tools is used by companies to determine the level of profitability. The Break Even formula in sales in dollars is calculated by sales price per unit into Break Even point in units.

The annual fixed expenses to run the business are 15000 and variable expenses are 750 per unit. Break-even points in units 1000. Sams Sodas is a soft drink manufacturer in the Seattle area.

As a reminder use the following formula to find your break-even point in units. Dont worry this is a pretty common scenario since most companies sell multiple products. Break-even point units fixed costs sales price per unit variable cost per unit Or in sales dollars using the formula.

Sale price per unit Variable costs per unitSale price per unit. Suppose for example you run a manufacturing business that is involved in manufacturing and selling a single product. Break-Even Analysis BREAK-EVEN TABLE 1083300 300 3249900 13000000 100 100 Page Total Fixed Costs Total Variable Costs Total Sales Revenues Number of Units Dollars Break-Even Analysis BREAK-EVEN CHART sample1 Village Software current1 Created by Developer on 82899 100 000 100 000 10000000 100 2500000 100 500000 0.

A startup business will utilize a Break Even Analysis to calculate whether or not it would be financially viable to produce and sell a new product or pursue a new venture. Retailers use this key concept to understand how much units must be sold to meet the minimum costs and manufacturers use it to calculate the number of units that must be manufactured and sold during. Q is the break even quantity F is the total fixed costs P is the selling price per unit V is the variable cost per unit.

In the first formula you divide the total fixed costs by the difference between the unit price and variable costs. One for per unit sold and one for sales revenues.

Break Even Price Economics Help

Break Even And Shut Down Points Of Production Cfa Level 1 Analystprep

How To Calculate My Business Break Even Point Trailhead Accounting Solutions Cpa Quickbooks Online Bookkeeping Experts Longmont Co

Service Business Break Even Analysis Plan Projections

Tanro Break Even Analysis Break Even Formula

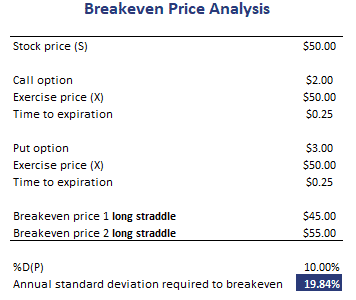

Break Even Price Analysis Breaking Down Finance

Break Even Economics Wikipedia

Break Even Price What Is Break Even Piont In Accounting